Who We Are.

We act as a bridge between visionary entrepreneurs, growing business concerns, the National Security ecosystem, and a curated group of investors and private capital partners.

read moreOur Partners

Mitigating Risk for our Investment Partners.

Every investor seeks to mitigate risk, maximize return, and do good in the process. Falcon Eye Ventures improves the probability of investment success with deal flow that leverages non-dilutive capital as well as matching investment funds from public sources. We further reduce risk by partnering with incubation and accelerator organizations that aligned with our mission and dedicated to the success of our portfolio companies. Our investment partners cover a full capital stack from debt financing to early-stage funding, private equity, and late-stage growth funding.

Unlocking Growth for Startups and Emerging Technology Companies.

We believe in reducing barriers to success and mitigating startup challenges through securing non-dilutive capital, bringing industry sector expertise, fractional executive support, merger and acquisition strategies, term sheet development, and access to resources at steep discounts or at no cost. Through our partnered business incubators and accelerators, we provide structured support to help businesses navigate funding, compliance, and market expansion. We serve a broad range of business maturity levels and thus have a flexible capital and service model that meets our portfolio companies where they are at and helps them get to the next level. Whether our portfolio companies are seeking early-stage funding, backing for an acquisition, or late-stage growth funding, we provide the right type of capital and expertise.

Experience

Counts.

Founded by industry veterans, FEV is committed to fostering a robust ecosystem where startups, growth-stage companies, and strategic investors thrive together. Our approach goes beyond funding—we bring insight, mentorship, and a long-term partnership mindset to every relationship.

LEADERSHIPCapital Stack.

Falcon Eye Ventures serves a broad range of portfolio companies with access to the right type of capital. Through our network of capital partners, we can provide early-stage funding, debt financing, backing of mergers and acquisitions, or large institutional investments.

- Debt Lending: Debt loans, contract factoring, and/or convertible notes

- Seed Funding and Venture Capital: Early-to-late-stage funding for start-up costs to build momentum

- Growth Equity: Capital for expansion and growth and expansion.

- Mergers and Acquisitions: Funding for strategy mergers and acquisitions to achieve company growth and expansion goals and/or exit strategies.

Comprehensive and Fractional Services to Drive Growth.

Falcon Eye Partnerships offers a comprehensive suite of services designed to support our clients’ operational and strategic needs through fractional services from the back office to the C-Suite and Board Room:

- C-Suite: Fractional C-Suite support from industry sector specific experts

- Finance and Accounting: GAP and DCAA compliant financial management solutions

- CMMC NIST-800 Compliant IT Services: Ensuring secure and compliant IT operations are identified, implemented, and maintained.

- Branding and Marketing Communications: Enhancing visibility, branding and market positioning across all media types, communication channels and engaging events.

- Proposal and Capture Management Services: Maximizing competitive advantage in federal and commercial procurements with winning proposals.

- Program Management Services: Delivering structured and efficient project execution and CMMC compliant tools.

- Security Office Services: Providing expertise in facility and personnel security, FSO, CUI, and ITAR compliance.

- Human Resources and Recruiting: Supporting talent acquisition and workforce development to assist our clients in staffing key roles.

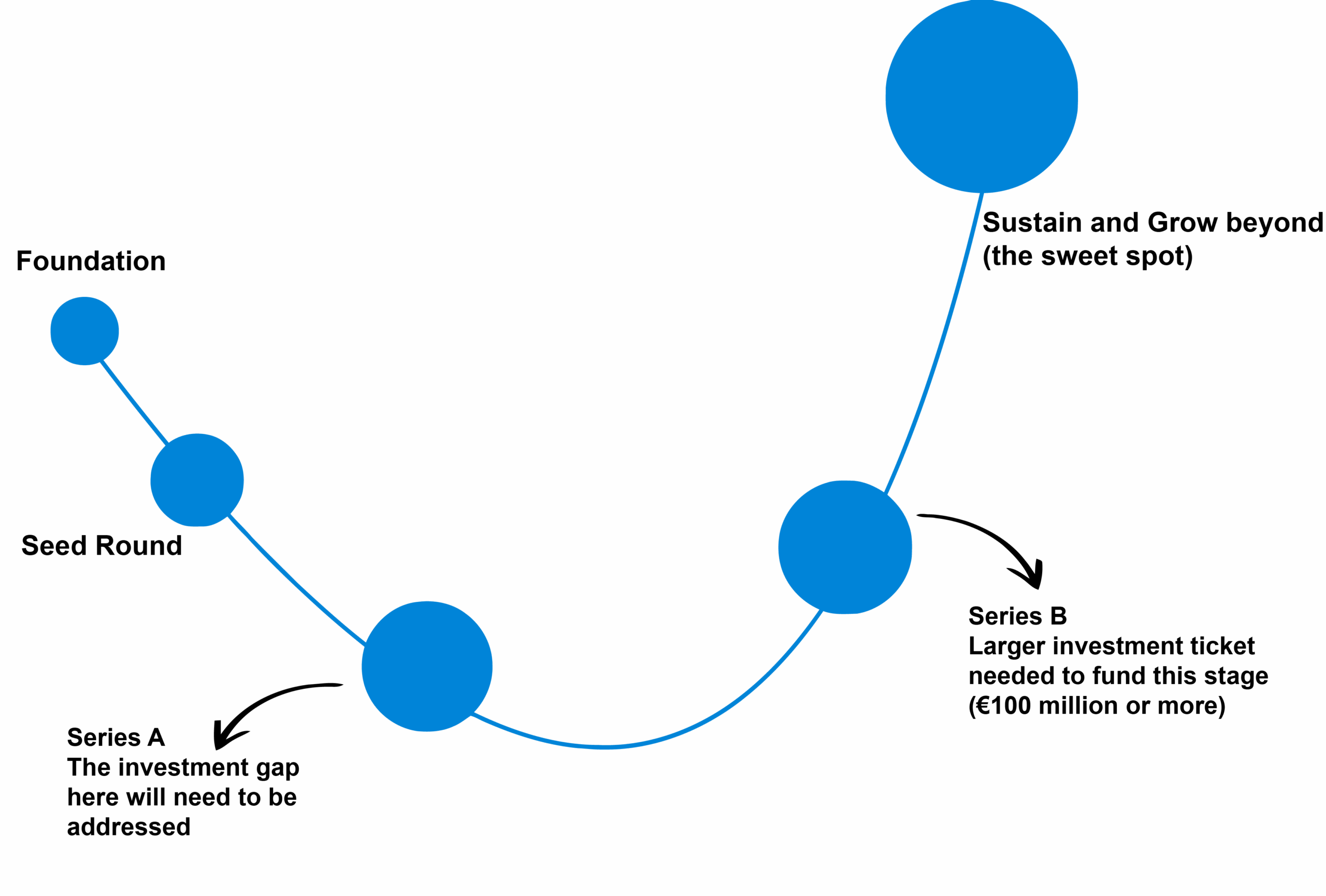

Valley of Death.

Falcon Eye Ventures (FEV) helps companies navigate and overcome the “valley of death”—the critical gap between early-stage research and market-ready products—by providing not just capital, but strategic support tailored to the needs of our portfolio companies. We connect innovators with a trusted network of investors who understand the long timelines, technical risks, and regulatory complexities involved. By pairing funding with mentorship, partnership opportunities, and access to key stakeholders in government and industry, FEV accelerates the transition from prototype to production, ensuring that promising technologies don’t stall due to lack of resources or market access.

solutions

Valley of Death.